The smart money concept originated from the gambling industry. It refers to the sum of money used by an individual or group of gamblers with an in-depth knowledge of gambling. They may have far experience or have access to insider information that ordinary gamblers can not access, which leads to effective decision making.

This type of gambler is termed to be successful, and knowledgeable in their field. Hence, common gamblers are eager to follow their leads by betting on what they put their money into. Thus, the phrase ” follow the smart money”.

This article explains the smart money concept in crypto, and how you can track and follow them.

What is Smart Money?

There may not be a generally accepted definition of the term smart money, but explaining the concept and the working principle gives a better understanding of the term in the crypto industry.

A few would agree with the fact that smart money is money controlled by the big players in the crypto industry. These players we refer to as whales, VCs, institutional investors, hedge fund managers, and market markers. It’s believed that these players have a full and complete understanding of how the crypto market works. Therefore, the majority of the trades or investments made by them end up in profit.

Others believe smart money is the smartest and biggest player in the industry. The amount they control can move the market in any direction. Well, it could also mean the amount of money invested by individuals with information that is not known to the retail crypto investor. With the help of such information, they buy into early promising projects at a very cheap price before other investors know about it.

Why is Smart Money Important?

Many believe successful investors know and do things that made them successful. Hence, newer investors want to follow that same path. Following smart money moves can be an investment that brings in profit, and this makes retailers want to do what this smart money is doing.

Smart money buys new and unknown projects at a very early stage. This gives them a better ROI over time, which is normal in the crypto industry. The early buyers are mostly the biggest winners.

They are market pioneers. They have what it takes to spot new trends, which gives them an edge in getting in early. The smart money has the ability to make a move on the market with the size of their portfolio. Also, they can be savvy investors with years of experience and knowledge. They also have access to insider information, and could never be wrong.

Think of it this way, CZ (CEO of Binance) coming out to say, he’s investing in X and Y projects. I bet everyone would want to put their money on the X and Y projects. That’s how important smart money moves can be.

How to Identify and Follow Smart Money.

The purpose of the smart money concept is for retail investors to invest/buy into the same project as the smart money. This gives them an advantage of lowered risk, for they are getting in early. Also the benefit of making a better ROI.

Below are some ways you can see what these crypto smart money(whales) wallet addresses. You can see their transaction activities, what they are holding, and for how long. The coins they are buying and selling, and in what quantity.

Having this knowledge can help a retail investor in making an effective decision on what investment to make.

Etherscan

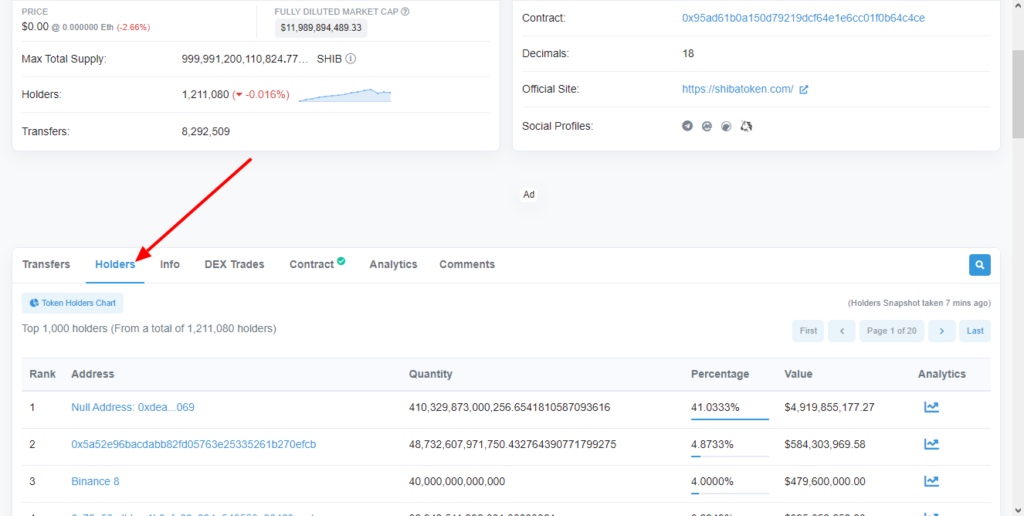

This is the blockchain explorer of the Ethereum network. Etherscan gives detailed information about any wallet address on its blockchain. It tells you, the time, date, and the amount of transaction made. When and where it was transferred to/from? and so on.

Retailers use this to track whale wallet addresses by simply looking for a token with smart money flow. Then go to the Etherscan and look up the top holders of the token. This will bring out lists of wallets with large amounts of the token. Copy the wallet address and look it up to see what other activities the wallet is performing. Such as buying new tokens, protocol interaction, and more.

Zapper Fi

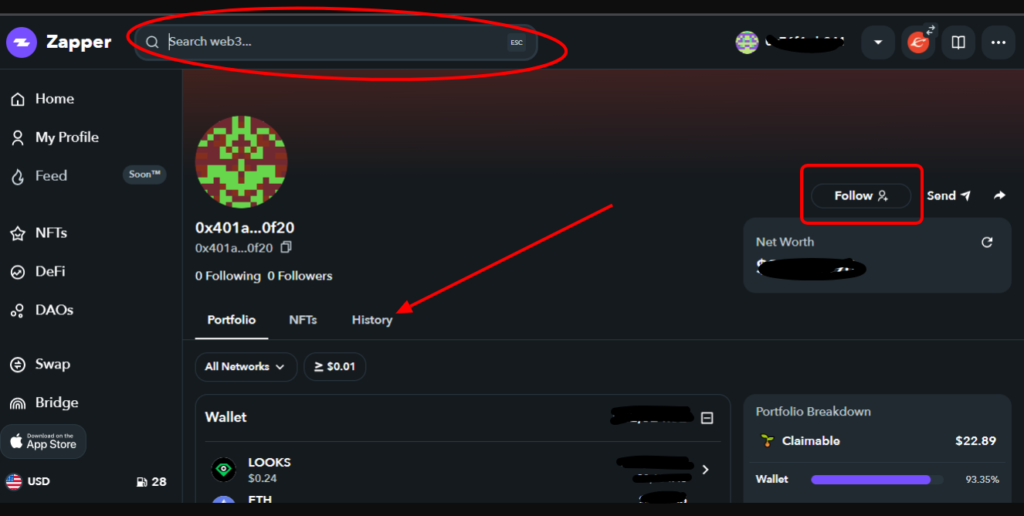

Zapper is home to web3. It allows you to track your personal wallets, and search and follow other wallets to see what they are buying and selling.

Paste the copied whale wallet address or any person’s address on ZapperFi to see the activities of such wallet. It shows you what they are holding, selling, buying, and more. It brings out the history of such wallets, and Such information helps common retail investors to make a decision that will lead to a greater ROI.

DeBank

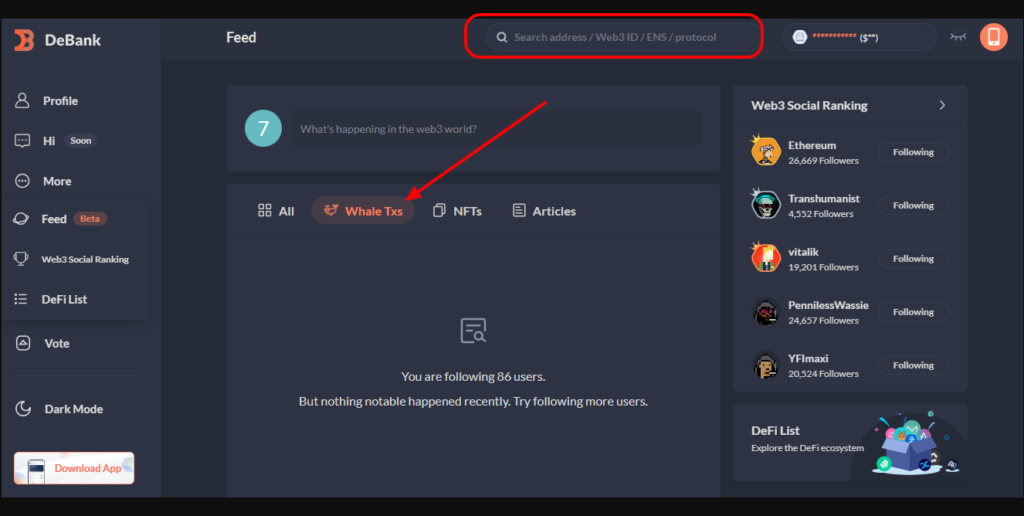

This is an all-in-one cryptocurrency dashboard that allows users to track their full portfolio across various chains. DeBank provides users with a simple overview of their holdings, positions, outstanding debt on loans, and pending rewards.

It has a feature that allows you to see whale transactions and know what they are doing.

Dune Analytics

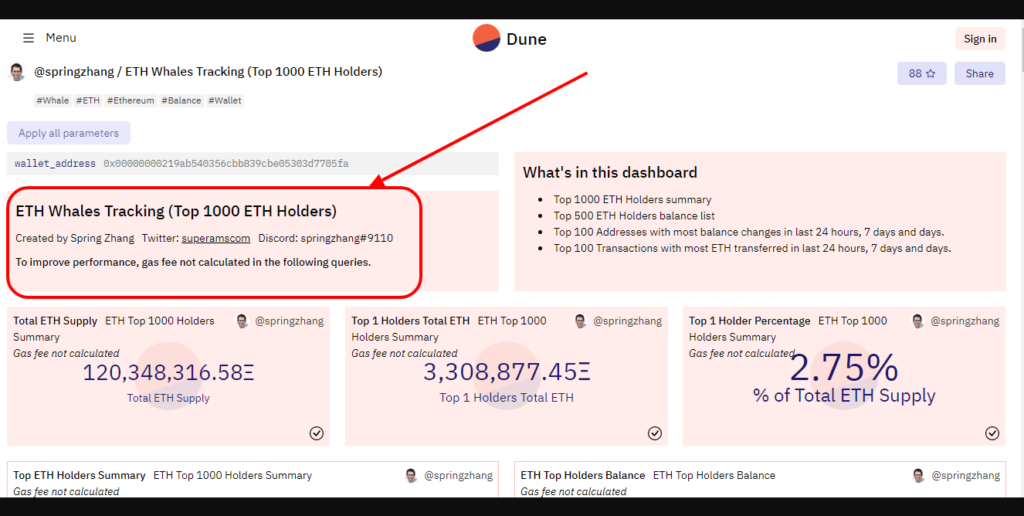

Dune Analytics is a data platform that crypto analysts and investors use to research specific projects. The whale tracking dashboard shows the top 1000 eth holders and what they are doing.

Lastly, there are other platforms that provide well-detailed information on whale wallets and smart money moves. Nansen and Messari are among these platforms, but it comes with a fee.

Conclusion

Hard work, luck, or cheating are ways to make it in crypto. While some still believe following the smart money move is a degen play that requires luck, others say it is a “cheat hack” used by lazy individuals.

Whatever you may call it, if used in the right way, it brings a good return on investment. A better way of following the smart money move is to track what the big money is spending on and carry out proper research before putting in your cash.