Multisig means Multi-signature.

It’s a type of digital signature that allows two or more people to sign a document together.

A multi-signature, therefore, results from combining several unique signatures.

The multi-signature technology has been present in the cryptocurrency space, but the principle that it follows dates back long before the creation of Bitcoin.

In 2012, the Multisig technology was first used in Bitcoin addresses. A year later came the creation of multisig wallets.

There are many multisig address use cases, but most of them relate to security concerns.

How does it work?

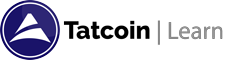

To simplify, imagine you bought a secure deposit box with two locks and two keys;

You hold one key, and your partner, Paul, holds the other.

In order to open the box, you must provide both keys at the same time, so no one can open it without the other’s consent.

Basically, multi-signature addresses secure funds by requiring the use of two or more signatures.

As a result, adding additional layers of security to your funds is possible through a multisig wallet.

In order to move on, it’s crucial to understand the basics of a standard Bitcoin address, relying on a single key (single-key address).

Single-key vs. Multisig

It is normally the case that Bitcoins are stored in standard, single-key addresses

This means that anyone with access to the private key can access the funds.

A single private key is all that is needed to sign transactions.

And anybody with this key can move the coins at their discretion, without needing permission.

The management of a single-key address is quicker and easier than managing one containing multiple signatures, but it presents a number of issues, particularly in terms of security.

Since cryptocurrency users only have one key, their funds are protected by a single point of failure.

This is why cybercriminals are constantly devising new phishing techniques to attempt to acquire their funds.

As a matter of fact, single-key addresses are not practical for businesses that work with cryptocurrencies.

You can picture a large company storing its funds in a standard address with a single private key.

As a result, the private key would either be given to a single person or to multiple people simultaneously – and that is clearly not the safest approach.

In both cases, a multisig wallet may provide a solution.

In contrast to single-key addresses, funds stored on multisig addresses can only be accessed with multiple signatures which you can only generate using different private keys.

Depending on the configuration of a multisig address, it may require a different combination of keys.

The most common combination is 2-of-3, where 2 individual signatures are enough to access funds from a 3-signature address.

In addition, there are also several other variations, such as 2-of-2, 3-of-3, 3-of-4, and so on.

Multisig use cases

This technology has a wide range of potential applications. Below are some of the most common uses of multi-signature cryptocurrency wallets.

Increasing security

With a multisig wallet, users can prevent problems due to the loss or theft of a private key.

Therefore, even if one key is compromised, the funds are still secure.

For instance, if you create a 2-of-3 multisig address you can store each private key separately on your device (laptop, phone, hardware password manager) or at a location.

It will be impossible for a thief to access your funds if only one of the keys is stolen from your mobile device.

Malware infections and phishing attacks are less likely to succeed, too, since hackers would likely be in possession of a single device and key.

Aside from malicious attacks, in the event you lose one of your keys, you can still access your funds.

Two-factor authentication

You can create a two-factor authentication mechanism for your funds by creating a multisig wallet with two keys.

Your laptop could contain one private key and your mobile device (or paper) could contain the other.

This would guarantee that only someone with access to both your keys would be able to make transactions.

Although using multisig technology as two-factor authentication can be safe, do keep in mind that it can be dangerous – especially if the multisig address is set as 2-of-2.

A lost key will prevent you from accessing your funds.

Hence, using 2FA services that offer backup codes or a 2-of-3 setup is the safer option.

Google Authenticator is highly recommended when dealing with crypto exchange trading accounts.

Escrow transactions

The creation of a 2-of-3 multisig wallet allows two parties (You and Paul) to create an escrow transaction

With a third party (Me) serving as a mutually trusted arbiter in the event of a problem.

In such a situation, if you deposit funds into the account, these funds would be locked up (neither you nor Paul would access them on your own).

Afterwards, Paul must provide the goods or services as agreed, and both of you must sign and complete the transaction with your keys.

It would be up to Charlie, the arbitrator, to step in if there were a dispute.

At that point, he would create a signature that would be given to either Alice or Bob depending on my judgement.

Decision making

It is possible for a company’s board of directors to control access to the funds by using a multisig wallet.

Using a wallet with a 4-of-6 arrangement, each board member retains a key, no individual can misuse the funds.

As a result, the majority can execute only those decisions that they agree on.

Disadvantages Of Multisig Wallets

Multisig wallets are an excellent solution for many problems.

However, you should keep in mind that they also come with some risks and limitations.

If you don’t want to use third-party providers, setting up a multisig address requires some technical expertise.

Blockchain technology and multisig addresses are both relatively new.

Hence, there may be difficulty seeking legal recourse in the event of an issue.

Wallets that have multiple keyholders do not have a legal custodian.

Wrapping it up

Although multisig wallets have some disadvantages, they have tons of interesting applications.

These applications make Bitcoin and other cryptocurrencies even more valuable and appealing, especially for companies and governments.

With multisig wallets, fund transfers requiring more than one signature and trustless escrow transactions are possible.

It is likely that this technology will gain more and more popularity in the future.